Andrew Griggs BA FCA CF

- Senior Partner and Head of International

- +44 (0)330 124 1399

- Email Andrew

Owner-managed businesses are the engines of the UK economy, contributing 50% of the UK’s private sector’s annual turnover. The success and financial health of these businesses are inextricably linked to the economic success of the country.

That is why every year the Association of Practicing Accountants (APA), a network of 20 advisory firms, including Kreston Reeves, representing 14,000 businesses nationwide, conducts a survey that provides a snapshot of the current landscape and explores the challenges and priorities of UK businesses.

This year’s report comes at a pivotal moment for the country. After 14 years of Conservative government, the Labour Party secured a historic election victory.

The report offers a clear call to action for the new government to provide the structured support they need to drive growth. Government needs to listen to the voices of owner-managed businesses and deliver a policy framework and regulatory environment that allows them to thrive.

This survey followed the previous government’s Spring Budget with just 2% of businesses surveyed saying it would make them better off against 24% saying it would leave them worse off. 83% of the business owners surveyed rated the previous administration’s support of the owner-managed sector as ‘poor’ or ‘very poor’.

The Labour government has quite a hill to climb, with just 30% of businesses surveyed believing a change in government would be good for their business against 45% who say it will not.

Labour has said they will be introducing a new mission-driven and future focused industrial strategy, working in partnership with industry to seize opportunities and remove barriers to growth. The Autumn Budget on 30 October will be a key moment for the new Labour government.

Continued uncertainty in the domestic and global economic climate has undoubtedly made the past 12 months a challenging period. Stubbornly high inflation has pushed up the cost of borrowing, and increased wages and supply chain costs. Respondents also commented on how the legacy of Brexit is still being felt:

“It is a challenging operating environment. Brexit has not been good for business or recruitment. Inflation and related movements in the cost of finance make it difficult to preserve profit margins.”

And, whilst inflation and interest rates have started to fall, those challenges seem unlikely to disappear entirely any time soon. 81% of businesses surveyed expect labour costs to increase and 83% of businesses expect supply chain costs to increase.

74% of the businesses surveyed are anticipating turnover to increase or remain the same in the next year. However, 28% believe their business is in a worse position, with 26% of businesses expecting turnover to fall. Businesses will need to look to grow their turnover from other sources than price increases. Businesses can explore the following growth strategies:

Interestingly, a quarter of the businesses surveyed are ‘unsure’ whether their business is in a better or worse position, suggesting that some work needs to be done to ensure they are on top of their business finances.

Half of businesses surveyed report their priority as ‘sustaining’ their business over the next 3-6 months with 28% focused on growth. 13% say they are in ‘survival’ mode, with a further 7% actively pursuing an exit.

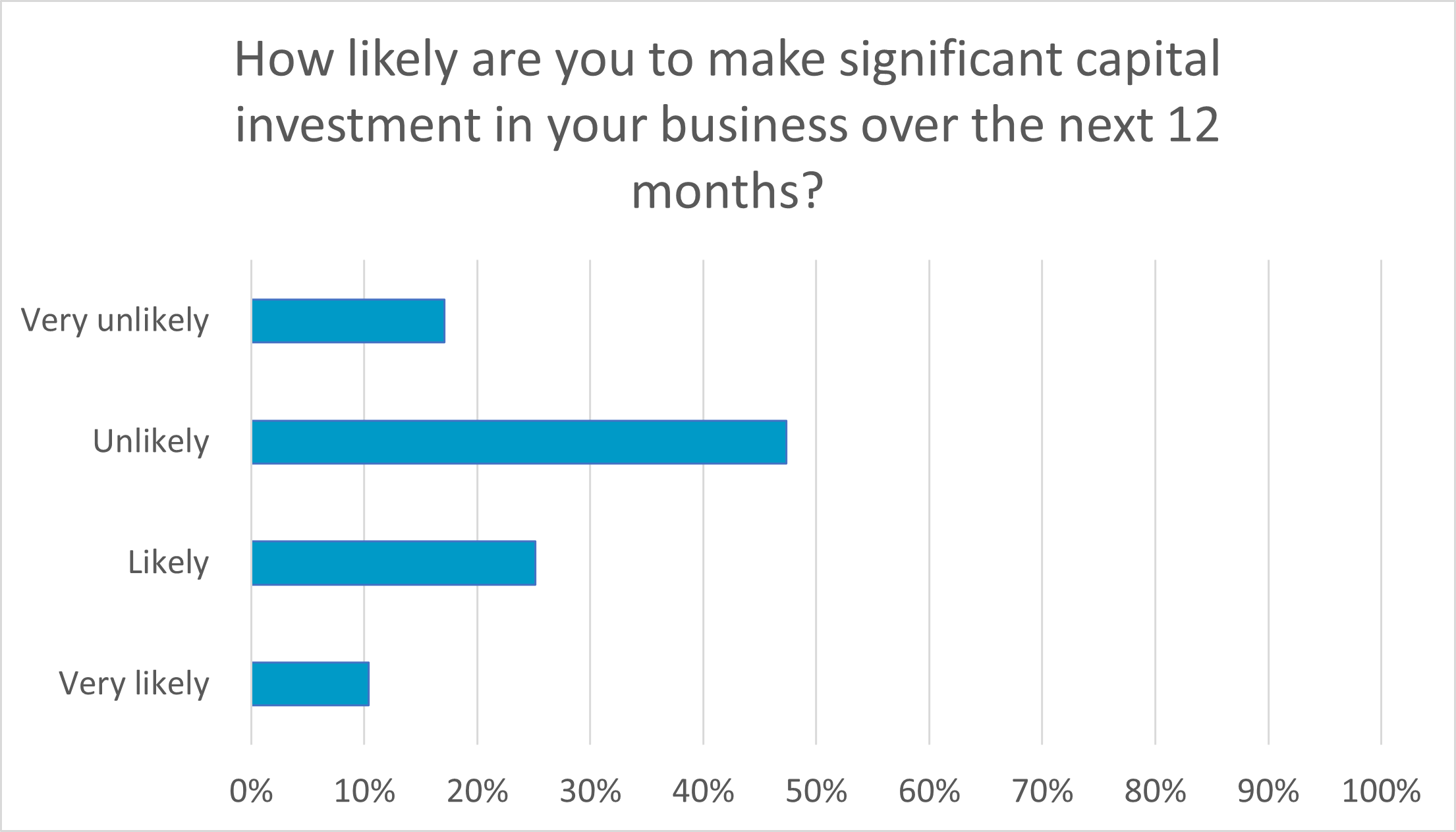

However, perhaps the most worrying picture for the new government is that 64% of businesses say they are ‘unlikely’ or ‘very unlikely’ to make any significant capital investment in their business over the next 12 months. As economists will confirm, investment is the root of economic growth.

The uncertain economic picture continues to bite, and government policy needs to reflect and encourage greater investment to deliver growth.

The Labour government needs to clearly demonstrate that it understands the needs of owner-managed businesses and is prepared to support them. Only then will the government achieve its primary mission to ‘kick-start’ the economy.

Here are a few suggestions on how it might achieve that:

Importantly, Labour needs to be seen to champion owner-managed businesses.

Owner-managed businesses are hopeful for the future, bringing astonishing levels of creativity, energy and passion to the UK. But now, as they have done so since 2020 and the onset of the global pandemic, businesses need to continuously prepare, plan and stay on top of their businesses.

Here are some suggestions on how that can be achieved:

We work alongside and advise many businesses on their business and growth planning. If you would like some guidance on any of the topics covered in this report, please get in touch.

The survey was conducted between May and June 2024 with the results published in August after the general election. A total of 512 businesses operating across 15 business sectors and drawn from all corners of the UK contributed to this research.

The APA is a Managing Partner led network of 20 leading business and professional advisory firms meeting the needs of owner-managed businesses and the real economy. APA member firms collectively advise and support well over 14,000 businesses with turnover up to the hundreds of millions. Our clients produce goods and services which help drive and jobs and growth across the UK and internationally.

Share this article

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Our complimentary newsletters and event invitations are designed to provide you with regular updates, insight and guidance.

You can unsubscribe from our email communications at any time by emailing [email protected] or by clicking the 'unsubscribe' link found on all our email newsletters and event invitations.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.