James Amico ATT CTA

- Private Client Tax Senior Manager

- +44 (0)330 124 1399

- Email James

Suggested:Result oneResult 2Result 3

Sorry, there are no results for this search.

Sorry, there are no results for this search.

View all peoplePublished by James Amico on 30 October 2024

Share this article

Capital Gains Tax (CGT) rates have increased but not as much as first feared. It was widely speculated that CGT rates would be significantly increased and gains could have been exposed to a tax rate in excess of 30%.

It was announced that the changes to CGT rates would apply immediately, meaning transactions on or after Budget day, 30 October 2024, will be subject to the new rates.

Individuals are entitled to an annual exempt amount of £3,000. Gains realised by selling chargeable assets which exceed this amount will usually be subject to CGT. The rate of CGT an individual is subject to is dependent on their level of income.

Prior to the Budget, different tax rates could apply to capital gains depending on whether they derived from residential property or other assets. The changes introduced align the rates of CGT.

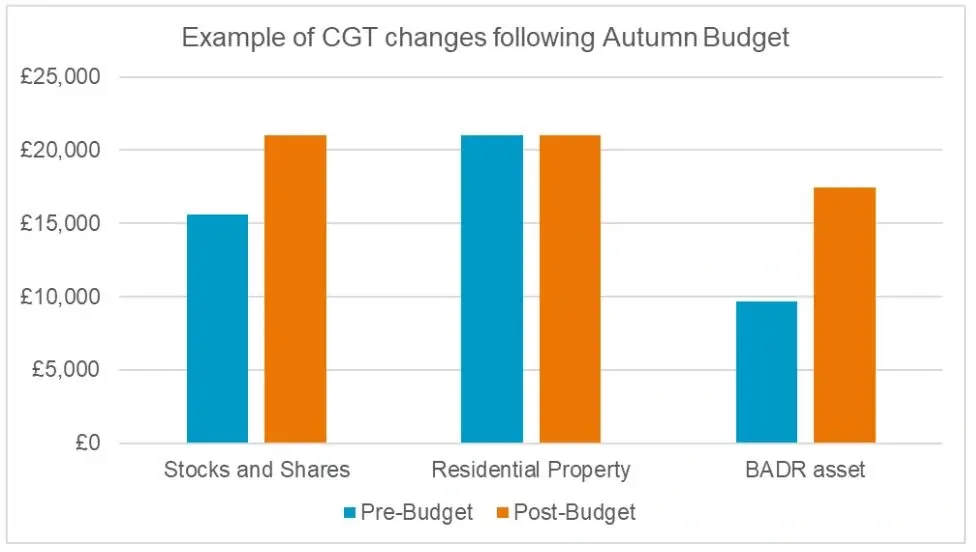

Taxable gains falling within an individual’s basic rate tax band will now be subject to a tax rate of 18% and taxable gains exceeding an individual’s basic rate tax band will be subject to a tax rate of 24%.

Currently individuals who sell certain assets or a trading business can qualify for a reduced CGT rate of 10% for gains falling within a £1m lifetime allowance.

Whilst the £1m allowance has remained the same, any gains realised from 6 April 2025 will be subject to CGT rate of 14%, and an 18% rate from 6 April 2026. Therefore, over the next 18 months, the timing in which an individual disposes of their business can have a significant impact on the resulting tax liabilities.

The following provides an example of the additional CGT charges an individual may incur when realising a gain of £100,000 from 6 April 2026.

Whilst changes to CGT were expected, they are not as severe as many commentators predicted.

Another allowance, Investors ‘Relief, has also been made less favourable with the lifetime allowance being reduced from £10m to £1m. In addition to this, the rate of CGT will align with the those being introduced to gains qualifying for BADR.

This relief works in a similar way to BADR. However, individuals or a connected person, cannot be an employee or officer of the company and therefore this relief is not as commonly used.

Carried interests, which are commonly used in Private Equity structures, are currently taxed at the residential property rates. From 6 April 2025 carried interest gains will be taxed at 32% and from April 2026 they will be subject to Income Tax, but with a 72.5% multiplier applied to the qualifying carried interest that is brought into charge.

Planning in advance of any disposal is highly recommended given the changes that are going to be made over the next few years in order to minimise your potential tax exposure.

Following the Autumn Budget 2024, our panel of experts examined the announcements made by The Chancellor, discussing what these changes mean for you. They also answered questions from our live audience. This webinar is now available to watch on demand here.

Alternatively, if you would like any further information or guidance on this topic, get in touch with your usual Kreston Reeves contact or contact us here.

Share this article

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Our complimentary newsletters and event invitations are designed to provide you with regular updates, insight and guidance.

You can unsubscribe from our email communications at any time by emailing [email protected] or by clicking the 'unsubscribe' link found on all our email newsletters and event invitations.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.