Daniel Robertson

- Business Development Manager at Kreston Reeves Financial Planning Services Limited

- +44 (0)330 124 1399

- Email Daniel

Suggested:Result oneResult 2Result 3

Sorry, there are no results for this search.

Sorry, there are no results for this search.

View all peoplePublished by Daniel Robertson on 9 October 2024

Share this article

For the first time in over four years, the Bank of England cut interest rates in, leaving investors wondering since August how much rates may continue to fall by and at what rate?

It was a close call for the Bank’s Monetary Policy Committee voting five to four in favour of the reduction in this move not seen since March 2020 – with closeness of the deliberation likely a reflection of timing rather than the overall direction.

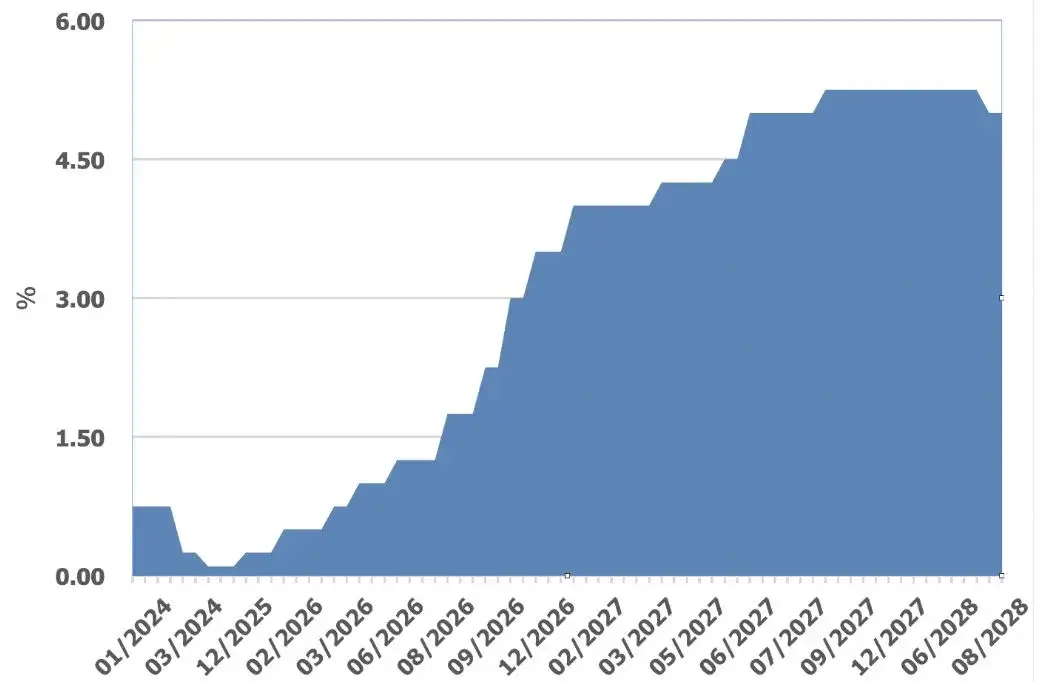

The Bank’s own economic outlook, based on probable future interest rates suggests the Bank rate currently at 5.25% may reduce to 4.2% in the third quarter of 2025, 3.8% a year later and 3.5% by the third quarter of 2027. This does not however take into account any unanticipated events, such as the 2008 financial crisis or 2019’s pandemic.

Although the near-zero rates of the 2010’s are not anticipated, everything continuing as it is, UK interest rates could be set for a downward trajectory.

The steady decline of interest rates may have several consequences for investors including:

With The Bank due to review its rate on 7 November, we look forward to confirmation of whether rates will indeed decrease and at what rate, but beware delays in either investing, or fixing part or all of your retirement income may prove costly.

To discuss investing or the taking or retirement benefits please contact our Financial Planning team on: +44 (0) 330 124 1399 or provide your details on our online enquiry form.

The content of this article is for information only and does not constitute formal financial advice. This material is for general information only and does not constitute investment, tax, legal or other forms of advice. You should not rely on this information to make, or refrain from making any decisions. Always obtain independent, professional advice for your own particular situation.

Sources:

The Bank of England: https://www.bankofengland.co.uk/monetary-policy-summary-and-minutes/2024/september-2024

Share this article

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Our complimentary newsletters and event invitations are designed to provide you with regular updates, insight and guidance.

You can unsubscribe from our email communications at any time by emailing [email protected] or by clicking the 'unsubscribe' link found on all our email newsletters and event invitations.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.