Jennifer Williamson BSc (Hons) FCA

- Accounts, Tax and Outsourcing Partner

- +44 (0)330 124 1399

- Email Jennifer

Suggested:Result oneResult 2Result 3

Sorry, there are no results for this search.

Sorry, there are no results for this search.

View all peoplePublished by Jennifer Williamson on 3 November 2020

Share this article

Last updated 3 November 2020

5 November 2020, 12:30PM: Chancellor Rishi Sunak announced changes to the Coronavirus Job Retention Scheme which will postpone the introduction of the Job Support Scheme until further notice.

On 31 October 2020, it was announced that the Job Support Scheme (JSS) has been postponed until 1 December 2020, when the extended Job Retention Scheme ends.

On 24 September 2020, Chancellor Rishi Sunak announced the replacement to the Coronavirus Job Retention Scheme that is scheduled to end on 31 October 2020. An extension and changes announced on 9 October and 22 October respectively have changed some important aspects of the scheme.

The Job Support Scheme (JSS), starting on 1 December 2020, will operate for six months and there are now 2 distinct types of JSS:

1. JSS Open – for businesses operating but facing decreased demand

2. JSS Closed – for employers who have been legally required to close their premises as a direct result of coronavirus restrictions

Yes, the scheme are open to all SMEs, but large businesses will have to undertake a Financial Impact Test, where turnover is lower now than before experiencing difficulties from COVID-19. Find out more.

On 9 October 2020, the government announced that the JSS will be expanded to support businesses across the UK required to close their premises by law due to coronavirus restrictions. In this case, the government will support eligible businesses by paying two thirds of each employees’ salary (or 67%), up to a maximum of £2,083.33 a month. Find out more.

The extension of the scheme does not cover businesses who are required to close as a result of specific workplace outbreaks.

Yes, the scheme is only available for those employees on the payroll on or before 23 September 2020 but can be on any type of contract including:

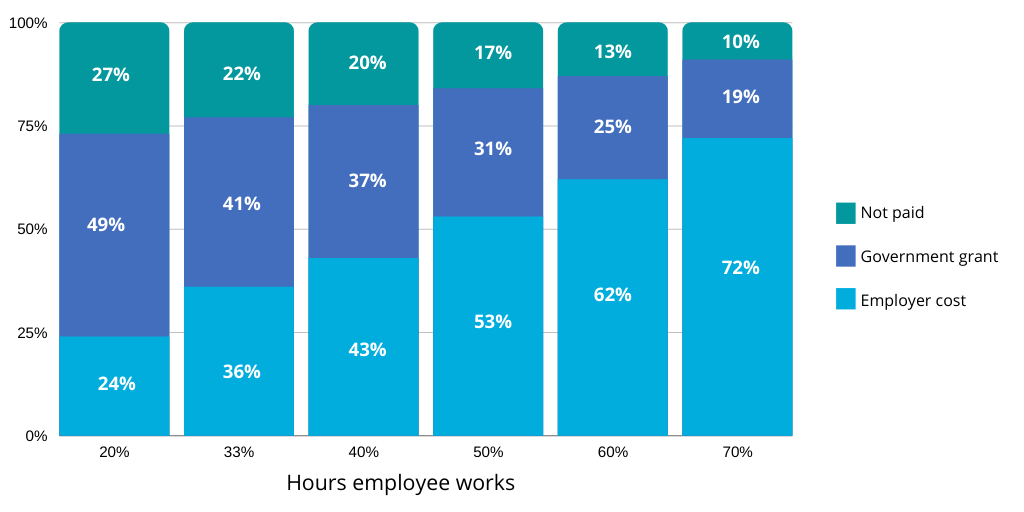

For the first three months of the scheme, the employee must work at least 20% of their usual hours.

After 3 months, the Government will consider whether to increase this minimum hours threshold.

Employees will be able to cycle on and off the scheme and do not have to be working the same pattern each month. Working arrangements though must cover a minimum period of seven days.

For businesses that have been forced to close due to coronavirus restrictions, employers must be instructed to and cease work for a minimum of 7 consecutive days.

The JSS Open grant will cover 61.67% of the usual hourly rate for every hour not worked by that employee, up to £1541.75 a month.

For businesses that have been forced to close due to coronavirus restrictions, the JSS Closed government grant will pay two thirds of each employees’ salary (or 67%), up to a maximum of £2,083.33 a month.

The grant does not cover Class 1 employer NICs or pension contributions, and these contributions remain payable by the employer.

Full details on the calculations will be released in further guidance, however it is expected it will follow a similar methodology of the Coronavirus Job Retention Scheme.

Yes, furloughed employees will have their underlying usual pay/hours worked used to calculate usual wages, not the amount they were paid whilst on furlough.

Employers will be able to make a claim online through Gov.uk from December 2020. They will be paid on a monthly basis.

Employers using the Job Support Scheme will still be able to claim the Job Retention Bonus if they meet the eligibility criteria.

As we are now very used to, there will be more detail released over the coming days and weeks. It is clear that once again though there is a need for strong records – hours forming the basis of any claim.

The Chancellor has widely told us this is not designed to save all jobs, as that, unfortunately, is not possible we know. However, this support, together with the Job Retention Bonus at the end of January may be enough to keep many people employed. It is also widely recognised that retaining good staff is beneficial to most businesses and the hope is that many sectors for which this is aimed can be those that bounce back relatively quickly.

Share this article

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Related people

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Our complimentary newsletters and event invitations are designed to provide you with regular updates, insight and guidance.

You can unsubscribe from our email communications at any time by emailing [email protected] or by clicking the 'unsubscribe' link found on all our email newsletters and event invitations.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.