Emily Baldwin FCCA

- Outsourcing Senior Manager

- +44 (0)330 124 1399

- Email Emily

Suggested:Result oneResult 2Result 3

Sorry, there are no results for this search.

Sorry, there are no results for this search.

View all peoplePublished by Emily Baldwin on 26 May 2022

Share this article

Making Tax Digital (MTD) has been around for the last few years, and many people may think it is all over now that the final phase of MTD for VAT has been introduced. As Winston Churchill once said, “this is not the end, this is not even the beginning of the end, this is perhaps the end of the beginning”.

Here is the current roadmap for MTD beyond VAT, bringing in MTD for Income Tax Self-Assessment (ITSA) and Corporation Tax (CT).

Since 2019 this has been in-place for VAT registered businesses with taxable turnover above £85,000.

For those that are under this threshold this now impacts you as MTD for VAT now need to be complied with by all VAT registered businesses unless and exemption has been approved by HMRC. This includes nil returns. If you hadn’t done so already, HMRC will have automatically signed you up.

Many people simply assume that MTD for VAT is just about electronically submitting their VAT returns and because they use an online software such as Xero that they are compliant. However, MTD for VAT has 3 requirements:

While firefighting through the pandemic many may have missed requirement 2 being the end of the soft-landing period in April 2021, which saw the introduction of mandatory digital links between your accounting data. It is therefore important to review your processes and ensure you meet the digital links requirements.

Read more about digital links here

Phase 1 will be introduced in April 2026 impacting:

Phase 2 will be introduced in April 2027 impacting:

A date has not yet been released for:

HMRC have indicated the following will be exempt:

HMRC are yet to release full detail on MTD for ITSA but have shared some initial legislation, so we do know partly what to expect from the process. We anticipate more detail from HMRC in the coming months.

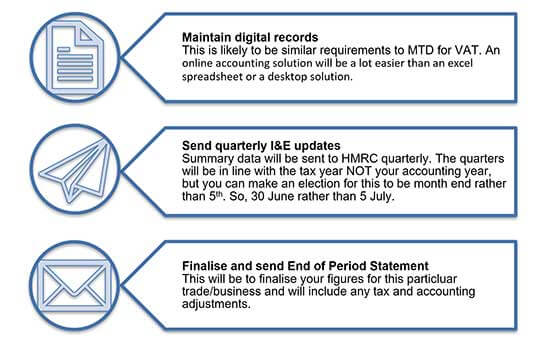

For each separate business/trade you will need to:

On top of these individual business/trade submissions, individuals will be required to submit a Final Declaration, which will replace the current self-assessment tax return and declare all income sources for an individual and calculate the tax position.

Therefore, someone with a sole trade business and a property business will need to make 11 submissions, rather than the usualone personal tax return a year. This is where an online accounting solution will be a lot easier than an excel spreadsheet or a desktop solution as it will allow effective collaboration with your advisor & simpler submissions to HMRC.

Online accounting isn’t just for the accountant or the tax man, there are a wealth of benefits for you as a business owner detailed here.

Share this article

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Our complimentary newsletters and event invitations are designed to provide you with regular updates, insight and guidance.

You can unsubscribe from our email communications at any time by emailing [email protected] or by clicking the 'unsubscribe' link found on all our email newsletters and event invitations.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.