Sam Jones CTA ACCA

- Corporate Tax Partner

- +44 (0)330 124 1399

- Email Sam

Suggested:Result oneResult 2Result 3

Sorry, there are no results for this search.

Sorry, there are no results for this search.

View all peoplePublished by Sam Jones on 12 May 2022

Share this article

Share options are a way of rewarding key employees by providing them with the opportunity to purchase shares in the company, typically at a discounted price. Being a shareholder in the company, your key employees can benefit from any increase in the value of the company as it grows, but how do you achieve this?

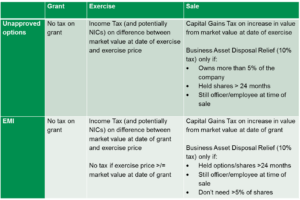

Certain schemes (unimaginatively called ‘tax-advantaged’ schemes) offer Income Tax and NIC benefits when compared to an unapproved share scheme.

The Enterprise Management Incentive (EMI) scheme is the most common scheme utilised by SMEs. Under EMI, a qualifying company can grant employees share options up to the value of £250,000 in a 3 year period. The employee will not suffer Income Tax or NIC’s if they buy the shares for at least the market value at the date they were granted the option. Any growth in share value from the date of grant of the option to the sale of the shares should be subject to tax at (currently) a 10% rate (up to £1m of gain) and 20% beyond that.

In contrast, where an unapproved share scheme is utilised, then any growth in the share value from the award of the option to exercise will be subject to tax and potentially NIC.

Very large companies and those with significant investment activities will not qualify for EMI. The other tax advantaged share schemes can be quite restrictive and therefore companies will need to consider an unapproved scheme or perhaps the utilisation of growth shares as a way of issuing shares to key employees.

As mentioned, there is a significant tax disparity between an EMI and unapproved share schemes. The table below sets out the tax implications of unapproved vs an EMI scheme:

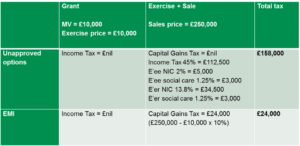

If an employee was awarded share options with a market value at a grant of £10,000 and were able to exercise these options on sale for a sales price of £250,000, there could be a tax differential of £134,000.

On a gain of £240,000 there could be an effective tax rate of 55% for an unapproved share scheme when compared to a 10% tax rate for an EMI.

What are the alternative options that you could consider to minimise this tax rate disparity? Issuing shares gives an initial tax charge, but even with this can give a beneficial tax outcome. You do need to consider the commercial issue of employees holding shares in the company (eg voting rights, what happens on resignation). This can be dealt with by means of a shareholders’ agreement or provisions in the company’s Articles.

‘Growth shares’ are often considered as an alternative to give additional flexibility and motivation.

Growth shares are a separate class of shares that entitle employees to benefit only in the growth in the value of a company. This class is often issued to members of a management team in order to incentivise them in the longer term, such shares typically rank equally with the existing shares as regards voting rights and entitlement to dividends; however, their entitlement to participate in the capital value of the company can be limited to any increase in value after the date of issue. This effectively preserves the historic value of the company to the founder shareholders, whilst giving management shareholders a stake in the value they add to the company going forward.

We have a specialist share scheme team who can work with you to design and implement a share scheme that meets your strategic goals, ensuring that the scheme is both tax efficient for the company and the employee.

For more information about the topic explored in this article, contact us here.

Share this article

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Our complimentary newsletters and event invitations are designed to provide you with regular updates, insight and guidance.

You can unsubscribe from our email communications at any time by emailing [email protected] or by clicking the 'unsubscribe' link found on all our email newsletters and event invitations.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.