Darren Hurdle

- Corporate Finance Director - Lead Advisory

- +44 (0)330 124 1399

- Email Darren

Suggested:Result oneResult 2Result 3

Sorry, there are no results for this search.

Sorry, there are no results for this search.

View all people

Management teams will often think an MBO is not an option because they do not have the full funds to buy the company. When funding an MBO however, the management team are usually only required to invest a relatively small sum as the rest is funded by institutions such as a bank or private equity house.

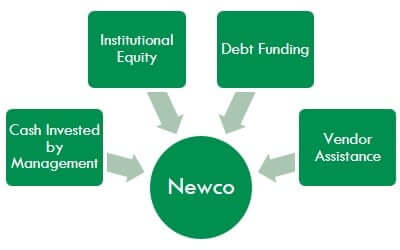

Sources of finance for an MBO and their key features are summarised below. Typically a combination of these different sources of MBO funding will be used.

Funding options

The amount of investment by the management team will be dependent on personal circumstances and the extent of any existing shareholding in the business. Generally, funders want the management team to be committed and look for an investment that the management team wouldn’t want to lose – typically known as ‘hurt money’.

A broad ‘rule of thumb’ is a sum of money that equates to one year’s salary for each team member but the amount invested can often be less.

Institutional Equity is funding provided by a private equity firm or venture capitalist in return for interest or an equity stake in the company. The investor benefits from interest income on the funding provided and capital growth in the equity stake.

Advantages:

Debt funding does not usually involve giving away a stake in the business. Funding is provided under pre-defined terms and re-payments are made according to a fixed schedule. Banks and Asset Based Lenders typically provide funding against assets including debtors, stock, plant and machinery, and property.

Cash Flow Loans can be provided by a debt funder using the expected cash flows that a borrowing company generates as collateral for the loan. The availability of these loans is dependent on a history of good cash generation.

Advantages:

Instead of the full consideration being paid to the seller/vendor on the day of completion, the vendor can agree to fund part of the buyout via deferred consideration or an earn-out.

Deferred Consideration: vendor defers all or part of the proceeds from the sale of a business and agrees that the purchaser can pay this over time from cash generated by the business.

Earn-out: a portion of the purchase price is contingent and is calculated based on the performance of the acquired business over a specified time period following completion. Earn-outs are intended to bridge a valuation gap between an optimistic seller and a sceptical, or cash strapped, buyer. Earn-outs potentially allow sellers to achieve a higher price and provide buyers with an additional financing option to pay for the acquisition with future profits of the business.

The role of a Corporate Finance Adviser in the fundraising for an MBO is vital. Every MBO is different so every funding package needs to be tailor-made. We have an extensive network of equity and debt finance providers, which enables us to tailor the funding for individual circumstances and achieve an appropriate and cost-effective funding solution for our clients.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Our complimentary newsletters and event invitations are designed to provide you with regular updates, insight and guidance.

You can unsubscribe from our email communications at any time by emailing [email protected] or by clicking the 'unsubscribe' link found on all our email newsletters and event invitations.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.