Watch our Autumn Budget 2024 question time webinar

Following the Chancellor’s announcement on Wednesday 30 October 2024, our panel of tax and business experts came together to answer your questions about the Autumn Budget, highlighting key implications, and providing insights and guidance so you can adapt to the changes.

Watch on-demand

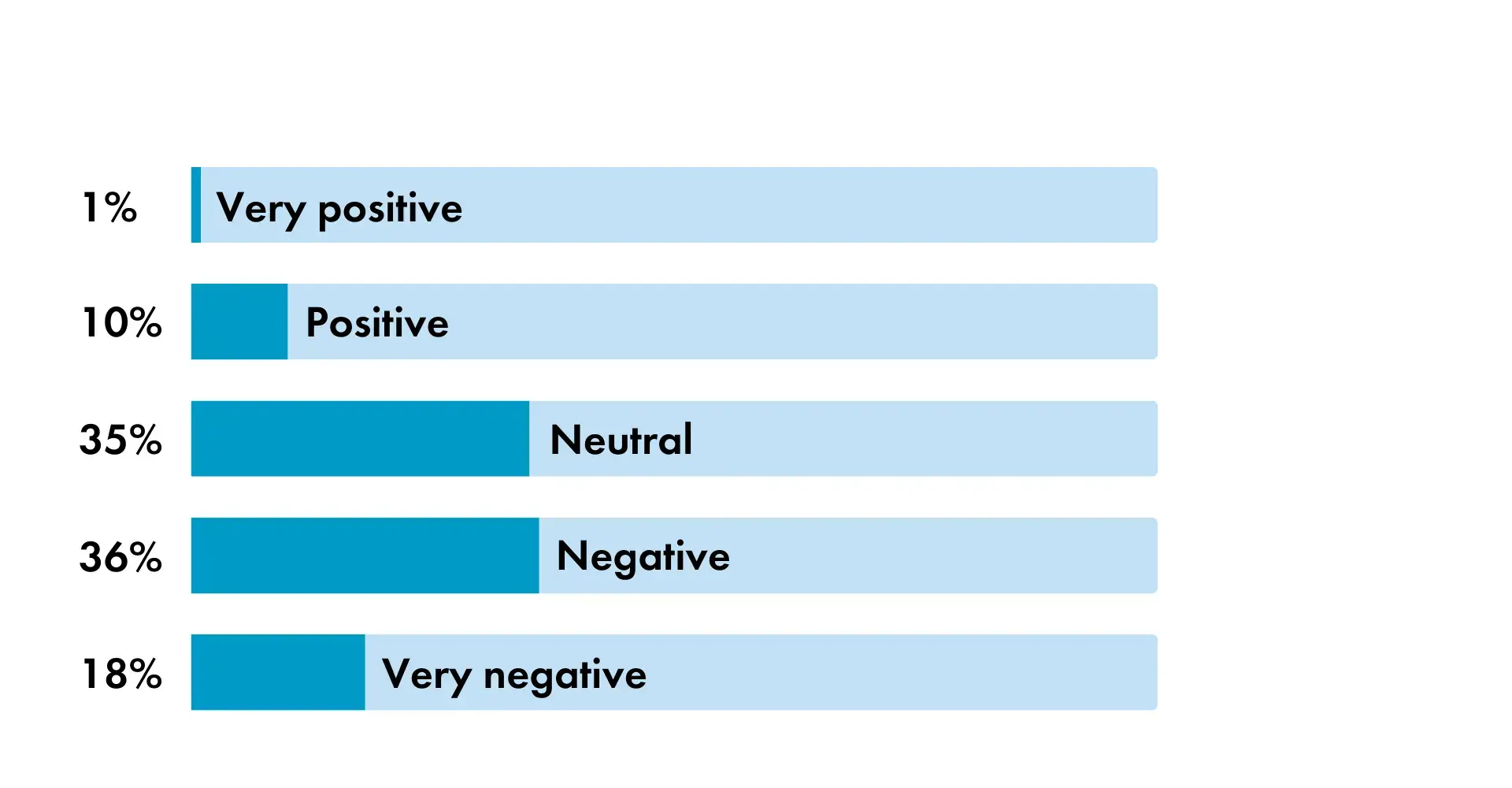

Poll results and additional insights

During our webinar, we asked our audience to take part in poll questions to get their views, see below.

Which of the personal tax changes will impact you the most?

Which of the personal tax changes will impact you the most?

Business owners, in light of the changes, what is the main priority for your business over the next 3-6 months?

Business owners, in light of the changes, what is the main priority for your business over the next 3-6 months?

Additional insights

Additional insights

To help you navigate the changes announced in the Autumn Budget, you can read our full Autumn Budget coverage and commentary here, which provides further reading on individual elements unveiled by the Chancellor.

If the Autumn Budget has raised any questions for you, or if you would like any further information or guidance on any of the topics covered in our webinar, please get in touch with your usual Kreston Reeves contact or contact us here.

You can also download our full Autumn Budget 2024 summary here and you can deep dive into all of our other Budget insights here.

Share this article

Rachel Emmerson ACCA FCCA

- Partner in Accounts, Outsourcing and Business Services

- +44 (0)330 124 1399

- Email Rachel

Email Rachel

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Related people

Daniel Grainge LLB (Hons) FCA CTA

- Partner and Head of Tax

- +44 (0)330 124 1399

- Email Daniel

Email Daniel

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Sam Jones CTA ACCA

- Corporate Tax Partner

- +44 (0)330 124 1399

- Email Sam

Email Sam

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Subscribe to our newsletters

Our complimentary newsletters and event invitations are designed to provide you with regular updates, insight and guidance.

You can unsubscribe from our email communications at any time by emailing [email protected] or by clicking the 'unsubscribe' link found on all our email newsletters and event invitations.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.